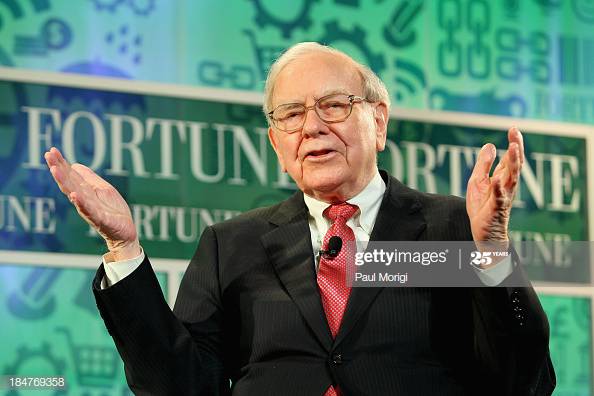

At the time of writing this article, Warren Buffett has a net worth of over $70 billion according to Forbes, and Berkshire Hathaway is the 3rd largest public company in the world with a net worth estimated to be approximately $710 billion. Read through Warren Buffett Lessons from his life experiences.

Warren Buffett is dubbed the Oracle of Omaha. A man whose name is synonymous with wealth and investing, a true modern icon of success. His life has been an interesting journey, with experiences that we can certainly benefit from. We’ll be looking at the key incidents in the life of Warren Buffett, and analyze how they serve as an important lesson to pay attention to while starting, growing, running, scaling and sustaining a business.

Warren Buffett Lessons

1) Resilience and Patience is a virtue

At the age of eleven, Warren Buffett bought 3 shares of Cities Service Preferred at $38. The stock went down to $27 shortly after the purchase. Warren was worried but he remained calm and waited for the share price to go up. When the price reached $40, he sold the shares. However, he soon regretted it because sometime later the share price shot up to $200.

This reflects the importance of staying calm and being resilient in difficult times. Had Warren panicked and sold the shares when they went down, he would have suffered a loss.

Although he did make a profit and smartly avoided making a loss earlier, Warren also learned his first investment lesson through this. He realized the importance of patience. Had Warren been patient and left the stocks as they were with a long-term approach in mind, he would have made much greater profits.

What Warren learned quite early on is a virtue we should familiarize and adopt. It’s intrinsic that we analyze any given situation completely in order to reap the maximum benefits out of it.

2) Have your own approach

Warren Buffett’s mentor, Ben Graham was a famed investor during the 1920s. Even though Buffett looked up to him, and held him in the highest regard, he had a completely different approach to investing then his mentor. Graham was concerned with numbers, while Buffett was more interested in the dynamics of the company and its competitors. Graham looked at the balance sheet and income statement, he didn’t think corporate leadership was important enough to evaluate or take into account while making his decision. On the other hand, Warren saw the company’s management portfolio as a major factor when deciding to invest.

What we learn here is that you can have mentors, professionals, and experts teach, guide, and help you over the course of your journey. However, having your own philosophy and unique approach is what makes you, you. What works for others might not work for you.

3) Have a valuable business partner

This has to be one of the most important Warren Buffett lessons to derive from his experiences. Warren Buffett and Charlie Munger have been friends for 60 years and partners at Berkshire Hathaway for 40 years. Buffett refers to Munger as his right-hand man.

Warren Buffett identified Charlie Munger as his ideal partner and convinced him to leave his second company to become the Vice Chairman of Berkshire Hathway. (CNBC) He realized the value Munger brought to the table, hence he did not go looking for a partner anywhere else. The two haven’t fought in the sixty years they have known each other.

Having a great partner is really important for your business. Keeping in mind all the years you’ll probably be working together, it is important that you identify the right partner.

Also see: How to Build a Startup Team

4) Never put all eggs in one basket

By the late ’70s, Warren Buffett never sold a single share of his company, and only lived off his basic salary. During this time, he made a comment to a broker, “Everything I got is tied up in Berkshire. I’d like a few nickels outside.” If something were to happen to Berkshire Hathaway, Buffett would have lost out on everything. Therefore, he then started investing for his personal life.

What this teaches us that we should never rely on one source and bet everything we have on it. The smart thing to do is to have multiple means and sources. Even if a couple go down, you have the others to back you up. This way not only are you able to sustain, but you can also work to bring back the ones that went down.

5) Do not let emotions cloud your judgment of doing what’s right

In 2011, Buffett’s successor candidate at Berkshire Hathaway, David Sokol, was accused of insider trading during Berkshire’s bid for acquiring Lubrizol. Even though Buffett had years and years of association with Sokol, he did not let it cloud his decision making. He called out his actions as inexcusable and within days Sokol resigned from Berkshire.

We should never let emotions and personal relations sway our decision making, or cloud our judgment. An effective businessman and company owner should always be able to make the right decisions, no matter how hard they might seem.

6) Know your capacity

Warren Buffett passed upon the opportunities to invest in the technology sector. When Warren met Bill Gates in 1991, Bill discussed the idea of a computer and how it would change everything. However, Warren did not get on board with this because the technology industry did not appeal to him and he simply did not understand it.

It’s important to know what your strengths and areas of expertise are. You don’t need to jump on every opportunity or understand every business. You need to know your capacity and what your sweet spot is.

Warren Buffett once said in an interview, “It took me 86 years to become Warren Buffett and the best is yet to come”. What an attitude to have! Warren Buffett has inspired generations after him. His experiences are invaluable, we should learn all that we can from them. This was Warren Buffett Lessons, if you liked this article, do share your thoughts in the comments section below.

Related: Improve Productivity at work