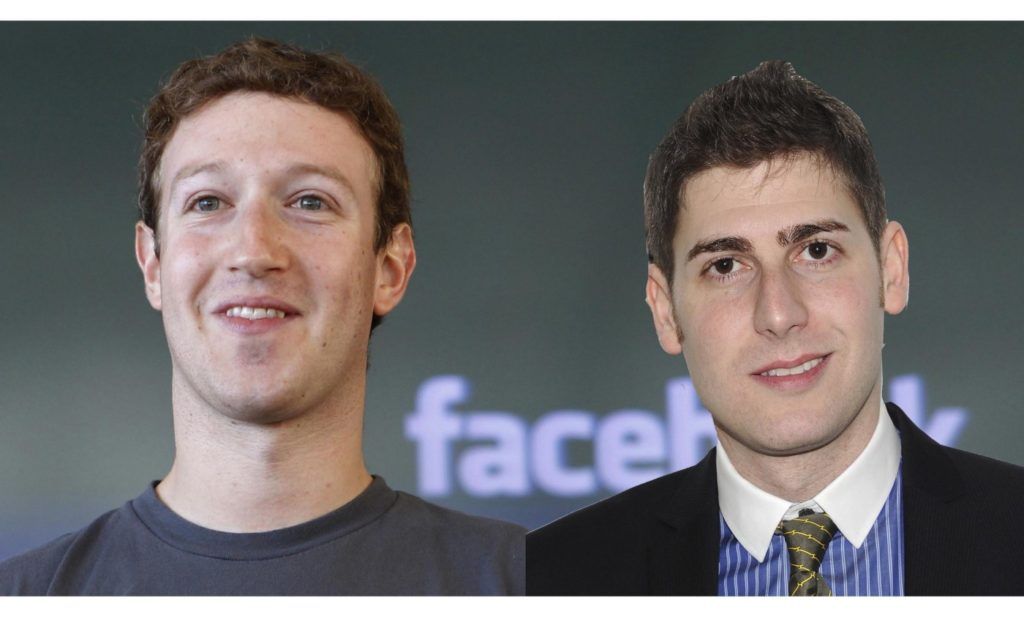

If you head over to Facebook’s Wikipedia page, you’ll see an unfamiliar name rooted in the founders’ section; Eduardo Saverin. Co-Founder Facebook and Mark Zuckerberg’s roommate at Harvard. What exactly happened to Eduardo? Why is that the pioneers behind social media giant Facebook, are relatively unknown as compared to Mark. Until 2009, Eduardo Saverin wasn’t even recognized as a co-founder. It took a lawsuit and a settlement to make that happen. Let’s take a look at what went down with Eduardo, pre, and post-Facebook exit.

Pre-Exit

In 2003, Mark approached Eduardo to discuss the idea of partnering up for Facebook. Mark offered 30% equity in return for $15,000 needed for the servers to run the site. When Facebook took off in 2004, Mark and another Co-Founder moved to Silicon Valley while Eduardo headed to New York for an internship. Mark lacked the business essentials that Eduardo had. Hence he tasked Eduardo with raising money and securing funding.

Mark thought Eduardo did not share the long term vision of Facebook. Eduardo prioritized the internship, was slow in making decisions and signing paperwork. Therefore, when Sean Parker came knocking on Mark’s door, Mark took him in. Sean quickly secured a $500,000 funding from PayPal Co-Founder Peter Thiel.

Instead of a fair dilution, Mark figured a way around limiting Eduardo’s say and ownership in the company. He created a new company that bought Facebook. This reduced Eduardo’s stake a little. Zuckerberg then issued 9 million shares from the new company and distributed these to everyone except for Eduardo whose stake went down from 30% to less than 5%.

Mark Zuckerberg also got Eduardo Saverin to sign a shareholder agreement. Eduardo was given shares in the new company, but his voting rights were taken away and given to Zuckerberg. Had Eduardo been able to hold on to his 30%, he would be worth a whopping $34 billion right now.

Business Insider was able to obtain the email Mark Zuckerberg sent to his lawyer asking him to draft the paperwork that would lead to Saverin’s dilution. Have a look at the email below.

Mark To His Lawyer

[Redacted],

This email should probably be attorney-client privileged, not quite how to do that though.

Anyhow, Sean and I have agreed that a price of one-half cent per share is the way to go for now. We think we can maybe almost justify and if not, we’ll just deal with it later.

We also agreed that if the company bonusing us the amount we need for the shares, plus tax, is a good solution to the problem of us all being completely broke.

As far as Eduardo goes, I think it’s safe to ask for his permission to make grants. Especially if we do it in conjunction with raising money. It’s probably even OK to say how many shares we’re adding to the pool. It’s probably less OK to tell him who’s getting the shares, just because he might have adverse reaction initially. But I think we may even be able to make him understand that.

Is there a way to do this without making it painfully apparent to him that he’s being diluted to 10%?

OK, that’s all for now. I’ll send you the list of grants I need made in another email in a second. Sean can send you grants for his people when he stops coughing up his lungs.

Hope you guys both feel better,

Mark

Lawyer’s Response

…I spent some time discussing the risks associated with making these grants and picking the per-share price of common stock. Mark, you and I should discuss these at length to ensure that you understand them. I’ve outlined them below for your easy reference.

The broad categories of legal risk are a) fiduciary duty. As Eduardo is the only shareholder being diluted by the grants issuances there is a substantial risk that he may claim the issuances, especially the ones to Dustin and Mark, but also to Sean, are a breach of fiduciary duty later on if not now. I believe that you previously disclosed these future dilutive issuances to Eduardo before the LLC merger. This is what I recommended at the time. Nevertheless, it would be great if there is some way you could obtain a shareholder consent from Eduardo approving these new issuances. It isn’t *required* but it would be very advantageous and would go a very long way towards preventing any future claims he might have for breach of fiduciary duty. I mentioned this to Sean and he was going to give it some thought…….

The lawyer was right to worry. Eduardo went on to sue Facebook. The lawsuit reached a settlement with Eduardo receiving a 5% stake in the company and recognition as Facebook’s Co-Founder. He also had to sign a non-disclosure agreement as part of the settlement.

Post-Exit

Since the settlement, Eduardo Saverin has sold more than half of his stake in Facebook and has invested in a few startups with great potential.

In 2012, he gave up on his US citizenship and moved to Singapore. A move claimed to have done to avoid taxes. However, he denied such claims stating that he is interested in working and living in Singapore. Since then, Eduardo kept himself busy. He made several investments which included Orami, Red-Mart and FlightCar.

In 2015, he co-founded his venture capital firm, B – Capital which was able to raise $350 million in its first round. The investments are focused on tech startups catering to health care, financial services and insurance. The firm has made 20 investments so far with Antler, MSwipe and Ninja Van being the most notable ones.

Eduardo Saverin is currently worth $10.3 billion, and owns 53 million Facebook shares.

Also Read: Startup Equity Explained