The summary of the Enron scandal is one of the most famous corporate scandals in history. It refers to certain events that led to the bankruptcy of the American Energy, commodities, and services company Enron. Moreover, the company’s downfall also brought about the dissolution of Arthur Anderson LLP, one of the largest accounting and auditing firms of its time. Enron’s sudden success made the fall from grace all the more surprising, shaking Wallstreet to its core. This article will give a summary of the Enron Scandal and how it affected the various parties involved.

Read: The PayPal Mafia

Enron’s Origins

Kenneth Lay founded Enron in 1985. The company was formed as a result of a merger between two natural-gas-transmission companies, Houston Natural Gas Corporation and InterNorth, Inc. Hence, the merged company, HNG InterNorth’s name was changed to Enron in 1986. Lay quickly converted Enron into an energy trader and supplier when he took over as CEO of the company. Deregulation of the energy markets in the 90s allowed companies to place bets on future prices, and Enron decided to take full advantage. In 1990, Lay created the “Enron Finance Corporation” and appointed Jeffrey Skilling, as head of the new corporation. Skilling was then one of the youngest partners at McKinsey and had greatly impressed Lay with his work.

Enron’s Success

Skilling joined Enron at a strange time, with the dotcom bubble in full swing. Internet companies had sky-high stocks and the trend to create your own website was at an all-time high. Hence, that is exactly what Enron did when they launched Enron Online (EOL) in Oct. 1999, an electronic trading website that focused on commodities. Hence, EOL was marked as an incredibly innovative venture at the time.

Furthermore, Jeff Skilling made Enron shift their accounting practices from the Historical method to a Market-to-market method. This would provide the company with a more realistic valuation and analysis of their current financial system. Some experts argue that MTM was the reason for Enron’s fall from grace as it allowed the company to show estimated profits as actual profits. However, Fortuned considered Enron as the “America’s Most Innovative Company” for six consecutive years between 1996 and 2001. Enron’s share price rose as high as $90.75 at its peak and would fall as low as $0.26 at bankruptcy.

Read: The Dotcom Tech Bubble: All you need to know

The fall of Enron

By the fall of 2000, Enron was starting to crumble under its own success. CEO Jeffrey Skilling hid the financial losses of the trading business and other operations of the company using mark-to-market accounting, as mentioned above. This technique measures the value of a security based on its current market value instead of its book value. Hence, it could be potentially disastrous for businesses that do not trade actual securities.

For Enron, these accounting practices help them deceive investors and other stakeholders. The company would create an asset such as a power plant, and straight away claim the expected profit on its books. Hence, even if the project or asset were to become unprofitable, its projected profits would be shown to make it seem successful. Similar fraudulent accounting activities were undertaken by the company to make themselves seem more profitable than they actually were.

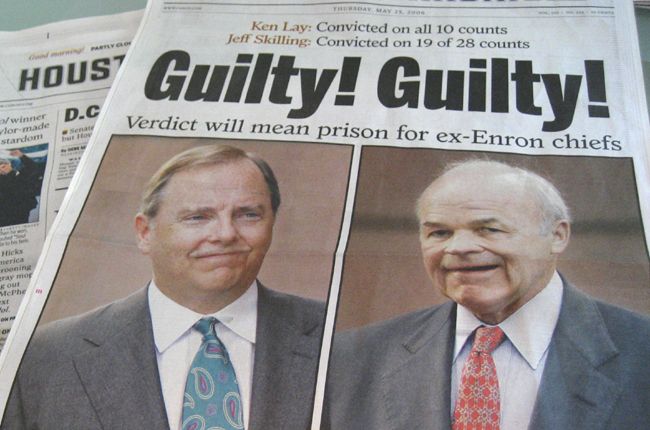

By the summer of 2001, Enron was in freefall. CEO Kenneth Lay had retired in February, turning over the position to Jeffrey Skilling. Moreover, in August 2001, Skilling resigned as CEO citing personal reasons. Around the same time, analysts began to downgrade their rating for Enron’s stock, and the stock descended to a 52-week low of $39.95. The SEC started their investigation into the company and found startling results. Enron had losses of $591 million and had $690 million in debt by the end of 2000. Enron filed for bankruptcy after Dynegy backed out of a merger deal in November 2001, with the company filing for bankruptcy in December. Investors would lose $74 billion in the four years leading up to their bankruptcy.

Arthur Anderson and Enron

Enron’s accounting firm Arthur Anderson LLP was a major player in the scandal. The company helped Enron hide its actual financial performance and showcase profitability to the rest of the world. David B. Duncan was the partner at the accounting firm who oversaw Enron’s accounts and was privy to their accounting practices. Hence, this was surprising considering Anderson was one of the top 5 accounting firms in the US at the time. Moreover, the firm kept on giving the seal of approval to Enron for their accounting practices, knowing very well how disastrous it could be. Hence, the firm was shut down along with Enron. They would face criminal charges which would prove to be their demise.

This was a summary regarding the Enron Scandal. This was one of the biggest business scandals in history. Where else do you think Enron went wrong? Let us know in the comments below!